Tuition

FXUA’s very competitive tuition rates, “business first” curriculum focus, and close alignment with numerous regional, national and international business partners ensures that you are able to fully-recover your educational investment, time and money, immediately at the conclusion of your academic journey!

Undergraduate Programs

Cost per semester:

$6,330*

(up to 21 credit hours per semester)

On-Ground

$422 / credit | $1,266 / 3-credit course

Online

$392 / credit | $1,176 / 3-credit course

*The tuition cost is based on 3 on-ground credits for 1 course

Undergraduate Degrees are 120 credits

Graduate Programs

Cost per semester for full-time enrollment:

$6,534*

(9 credit hours per semester)

$726/credit

On-Ground

$726 / credit | $2,178 / 3-credit course

Online

$508 / credit | $1,524 / 3-credit course

*The tuition cost is based on 3 on-ground credits for 1 course

Master’s Degrees are 36 credits

Graduate Certificates are 18 credits

varies per program

Standard Fees

All fees are non-refundable.

| FEE | DESCRIPTION | APPLIES TO: | AMOUNT |

| English Proficiency Test Fee | This fee is charged if a student takes the English proficiency/placement exam. There is a charge for each time that a student takes the exam. | Remote Placement Test | $55.00 |

| Tuition Payment Plan Fee | Applies to students who wish to finance their tuition in installments. This fee is charged per installment. | All Students | $30.00 |

| Transcript Request Fee | This fee is charged to students who request an official FXUA transcript. This fee is charged per transcript. Processing refers to internal production of the transcript in preparation for mailing; mailing times vary based upon the student’s chosen mailing speed. Factor in mailing time on the order. | Standard processing (5 business days) | $10.00 |

| Express processing (2 business days) | $25.00 | ||

| Document Mailing Fee | This fee is charged when students request official documents to be sent via mail (for example, I-20 documents, transcripts, diplomas or certificates, etc.). | Regular USPS Mailing (domesticonly) | No charge |

| Domestic Courier Service | $35.00 | ||

| International Courier Service | $100.00 | ||

| Program Exit Application Fee | This fee is charged when the student nears completion of their program and intend to complete or graduate. This fee is not associated with the commencement ceremony, and is charged regardless of the student’s intention to participate in the commencement. The fee covers costs of diploma/certificate creation, processing, and mailing. Any diplomas or certificates returned to the school as undeliverable will incur an additional Document Mailing Fee if the university needs to send the diploma/certificate to the student. | All Graduates | $150.00 |

| Diploma Replacement Fee | This fee is charged if the student requests an additional or replacement diploma. | All Students | $50.00 |

| Change of Program or Specialization Fee | Required for change of program of study or a change of concentration for existing students. | All Students | $20.00 |

| FXUA ID Replacement Fee | This fee is charged for tuition payments paid after the payment deadline. This fee may not exceed $500.00. | All Students | $10.00 |

| Late Payment Fee | This fee is charged for tuition payments paid after the payment deadline. This fee may not exceed $500.00. | All Students | 3% of outstanding balance due at the time of payment |

| Check Return Fee | Applies only if check received is unpaid by the bank. | All Students | $45.00 |

| Credit Card Charge- Back Fee | Applies if payment made by credit card is charged-back. | All Students | 3% of the charged-back amount |

| Wire Transfer Refund Fee | Charged if a refund is requested to be paid via a wire transfer. | International Wire | $45.00 |

| Domestic Wire | $35.00 |

*Application fee is valid for one year.

Other fees may include service and late fees. Please review the Academic Catalog for details and specific amounts. For cancellation and refund policy, please visit our Policies page.

Living and Other Expenses

Funds for personal expenses (e.g., room and board) are not included in FXUA’s tuition.

Use the Net Price Calculator to estimate your cost of attendance.

Cost of Living

The approximate cost for an individual student living in the Washington, D.C. metropolitan area.

Estimate Amounts: $12,680 per academic year (9 months)

Billing

By registering for classes, FXUA students accept responsibility for all semester charges that should be paid in full by the payment deadline each term to avoid financial penalties. Students are responsible for checking their billing information through their Student Portal and keeping their contact information up to date.

For more information on how to submit a payment using FXUA Student Portal and other methods of payment, please click here.

Payment & Refund Deadlines

Please see the calendar below for payment and refund deadlines.

| Summer I 2024 | April 29 – June 23 |

|---|---|

| Last Day to Apply for a Payment Plan | 5/6/2024 |

| Tuition Payment Deadline | 5/6/2024 |

| 1st Installment Due* | 5/6/2024 |

| First Day of Classes | 4/29/2024 |

| Last Day to Add/Drop Course(s) | 5/6/2024 |

| Eligible for 100% Refund | 5/6/2024 |

| Last Day for Eligible for 75% Refund | 5/12/2024 |

| 2nd Installment Due* | 5/29/2024 |

| Last Day for Elgible for 50% Refund | 5/26/2024 |

| 3rd Installment Due | 6/29/2024 |

| Last Day for Eligible for 25% Refund | 6/9/2024 |

| No Refund After This Date | 6/10/2024 |

| Last Day of Class | 6/23/2024 |

Payment Overview

The Accounting Office strives to make bill payment as easy as possible for students.

Making a Payment

For your convenience, you are able to make payments in the following ways:

Online

We encourage all students to take advantage of the easy and hassle-free option to make tuition payments by credit or debit card through the student portal. Avoid the wait and make your payment when it is convenient for you!

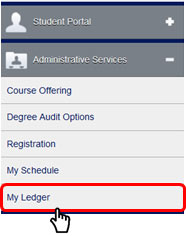

- Log in to the student portal with username and password.

- From the Administrative Services section of your left-hand menu, click “My Ledger“.

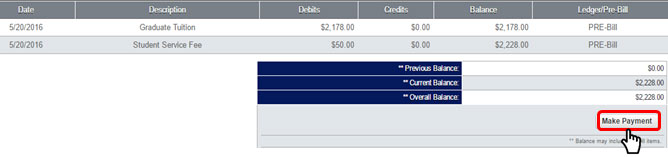

- At the top of the page, you may filter the charges on your account to show all charges or to show only fees.

- Make a payment by clicking “Make Payment” on the right side of the screen below your ledger balances.

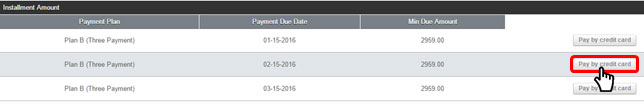

Alternatively, if you are currently on a payment installment plan, below the billing ledger you may select the current payment and click “Pay by credit card” to make your payment easily.

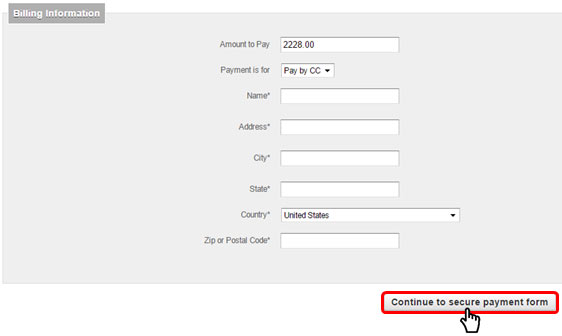

- On the Billing Information page, enter the amount you wish to pay and then select the payment method. Complete all of your personal information and then click “Continue to secure payment form“.

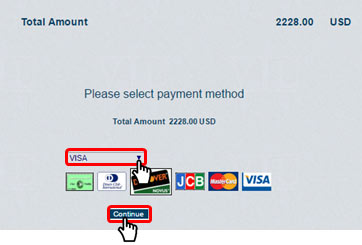

- On the next page, choose your card type and click “Continue“.

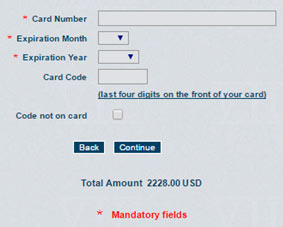

- Next, enter your credit card information then click “Continue” to finalize the payment.

- After your payment has successfully processed, you may print a receipt. The balance on your ledger may take 1-2 business days to update.

Note: Late fees are assessed on payments made past the payment deadline. If you have any questions regarding your account balance, please contact the Accounting Office at (703) 591-7042 x 335 or (703) 364-5449 x 416. You may also contact the Accounting Office via email at .

In Person

The Accounting Office is able to take your payments in person Monday through Friday until 6:00 PM. We accept payments by credit card, check, cash, or money order.

The Accounting Office will happily receive checks or money orders via mail. Please do not send cash payments via mail. Payments may be mailed to the following address:

Fairfax University of America

ATTN: Accounts Receivable

4401 Village Drive

Fairfax, VA 22030 United States

Please include your Applicant/Student ID # for processing the payments submitted by mail. The payments without identification cannot be processed.

Payment Methods

Credit and debit card payments are accepted at the Accounting Office and online through the student portal. FXUA accepts Master Card, Visa, Discover, and American Express. (Note: Online payments can be made by using multiple cards. Please note that the same card cannot be used more than once in the same day)

Checks should be made payable to Fairfax University of America with the student’s full name and/or student ID number written on the memo line. Checks which have already been endorsed or drawn from a foreign bank will not be accepted. Checks must be payable in US dollars (USD).

Cash is only received in person at the Accounting Office located at the Village Drive Campus (4401 Village Drive, Fairfax, VA 22030).

FXUA offers two options for students wishing to pay via wire transfer:

GlobalPay

We offer a simple electronic payment mechanism through Western Union Business Solutions called GlobalPay which allows students to pay tuition and fees using their local currency. Our hope is that this option will save students money on exchange rates and bank fees. Payments made via GlobalPay are credited directly to your student account in as few as two (2) business days.

Depending on your country and region, you may have different options for GlobalPay payment via local bank transfer, credit card, Western Union Agents, or ChinaPay. (More information is available here.) Your payment options and availability will vary by country and region.

For instructions on paying via GlobalPay, please click here.

Traditional Wire Transfer

- To make a traditional wire transfer to FXUA, please contact the Accounting Office at for further instructions.

- When sending a wire transfer, be sure to include the student’s full name and/or student ID number.

Money Order

Money orders should be made payable to Fairfax University of America.

Demand Drafts

FXUA will accept demand drafts (DDs) only if the funds are drawn on a US bank and in US currency. Drafts should only total the amount of tuition and fees for the semester for which the student is paying. All demand drafts received which exceed the amount of total tuition and fees for that semester will be refunded only after the Demand Draft is processed and settled.

Payment Reminders

- Please allow ample time for payment processing. Payments must be received by 5 PM to be considered as the same business day payment. Please click here to view more information about payment deadlines.

- Payments are applied to the oldest outstanding balance first.

- The Accounting Office does not accept payments over the phone.

Financial Penalties

Following are payment-related policies and penalties that may be incurred:

Late Fee

Other fees will be deducted before payments are applied to the outstanding tuition amount.

Returned Check Fee

A $45 fee will be charged for each unpaid check returned by the bank, plus any additional late fee penalties. Furthermore, FXUA will recalculate the late fee daily until the balance is cleared.

Credit Card Charge-Back Fee

A fee in the amount of 3% will be added to the student’s account for credit card charge-backs.

Wire Transfer Refund Fee

In the event that a student must receive a refund via wire transfer, a fee will be incurred to cover the cost of the transfer. International transfers will result in a $45.00 fee, and domestic transfers will result in a $35.00 fee.

Cancellation and Refund Policy

DEGREE PROGRAMS

A student may elect to cancel the Enrollment Agreement with no financial penalty at any point prior to the start of the semester or the end of the add/drop period. Any cancellation that takes place after the add/drop period will follow the university’s stated refund policy. All tuition refunds will be made within a period of 45-days following the cancellation notice.

Applicants, who have not visited the school prior to enrollment, will have the opportunity to cancel their enrollment without penalty within three business days following the regular orientation procedures and/or a tour of the facility to include inspection of the equipment used to provide training and services. There will be no penalty, and such individuals shall be entitled to a full refund.

If a student elects to drop one or more courses or withdraw from the university, the following refund schedule will be used to determine any outstanding financial obligation for which the student may be responsible:

| Last Day of Attendance Notice | Tuition Refund Amount* |

|---|---|

| Up to the last day of the add/drop period | 100% of the tuition |

| After the add/drop & through 25% of the session | 75% of the tuition |

| Through 50% of the session | 50% of the tuition |

| Through 75% of the session | 25% of the tuition |

| After 75% of the session | No refund will be issued |

*Excludes all fees

Student Accounts Office reviews the student accounts periodically and contacts students with an overpayment. Students can decide to request a refund or keep the overpayment balance to their account. The bank transaction fee, however, will be deducted from this total. In general, FXUA will refund the tuition deposit in the same manner as it was received by FXUA (credit card payment, bank wire transaction, or check). Please note, FXUA will only issue tuition refunds to the organization or person who made the original payment. All fees (application fee, postage fee, student service fee, etc.) are not refundable.

Student may submit a Refund Request Form to initiate the refund process. Students may download the form on our website or obtain a hard copy from the Accounting Office.

The official withdrawal date, for the purpose of a refund calculation, will be the last date on which the student was recorded present in attendance for a class. If no payment was made, or if the student was participating in a payment plan and the payments are insufficient to cover the student’s obligations according to the schedule above, the university will send the student a bill for the difference. If the student is financial obligation is not fulfilled, FXUA is authorized to do the following until the money owed is paid:

- Withhold the release of the student’s academic records or any information based upon the records.

- Withhold the issue of the student’s transcripts.

- If the student’s account remains delinquent, FXUA reserves the right to terminate enrolment and cancel F-1 visas of international students.

- Late tuition payments are subject to financial penalties.

- Financial hold will be placed and access to student portal and Canvas will be blocked.

To initiate the withdrawal process, the student must submit an Institutional Withdrawal Form to Fairfax University of America. Students may download the form from our website or obtain a hard copy from the Registrar’s Office or the Office of International Student Services.

Further details about this policy can be found in the Academic Catalog.

To request a refund please fill and submit the Refund Request Form to .

Institutional Withdrawal Policy

A student may withdraw from the university when circumstances beyond the student’s control make it impossible for him or her to complete coursework for the semester. A student wishing to withdraw from the university must complete the relevant section of the Institutional Withdrawal form, obtain the needed school officials’ signatures, and submit the completed form to the Registrar’s Office. The student will receive a grade of “W” if he or she withdraws between the second and tenth week of the semester for 15-week courses, between the second and fifth week of the semester for eight-week courses, or between the second and fourth week of the session for seven-week courses. A student who does not withdraw from the university before the deadline will receive a failing grade or a letter grade based upon his or her performance in the course(s). The institutional refund policy is applied to determine if the institution is required to provide a refund to the student. Students who fail to register by the end of the add/drop period are automatically considered to be officially withdrawn from the university.

To initiate the withdrawal process, the student must submit an Institutional Withdrawal form. Students may obtain a hard copy of the form from the Accounting Office.

Further details about this policy can be found in the Academic Catalog.

Special Cases

In special cases, such as in the documented event of prolonged illness, accident, or death in a student’s immediate family (parents, siblings, children, or spouse) or other special circumstances which make it impractical for the student to complete his or her program, Fairfax University of America will work toward a settlement that is reasonable and fair to both parties.

1098-T Overview

The 1098-T tax form is a Tuition Statement provided by higher education institutions to all eligible students who pay enrollment fees (including non-resident tuition) during the calendar year. This form may be used by students or parents to claim the American opportunity tax credit (formerly “Hope credit”) or Lifetime Learning Credit on their federal income tax returns.

Frequent Asked Questions

Am I eligible for a 1098-T?

Not all students are eligible to receive a 1098-T. Forms will not be issued under the following circumstances:

- Nonresident alien students, who is an international student and paid enrollment fees and non-resident tuition last year.

- If requested, FXUA can provide student account statement.

- Students whose qualified tuition and related expenses are entirely waived or paid entirely with scholarship.

- The amount billed for qualified tuition and related expenses in the calendar year is paid in full by a third-party organization.

- No qualified tuition or related expenses were billed in the calendar year. For example, a student who graduated in May 2020 in most cases would not receive a 1098-T for 2020 because all tuition for the 2020-21 academic year was billed in the calendar year of 2019.

It is also important to note that related expenses do not include charges for room, board, insurance, health fees, transportation or similar expenses.

Please note: Exceptions: ESL Students are not eligible to receive Form 1098-T since ESL is a noncredit program.

For more information about the 1098-T form

When it will be available?

It will be mailed to qualified students’ primary address by the end of January 2024.

How do I claim a tax credit and am I required to do this?

University staff cannot determine if you qualify for a tax credit or respond to tax questions.

Please contact the IRS for more information at www.irs.gov or at 1-800-829-1040 or consult your tax preparer.

I am not eligible to receive a 1098-T tax form. Can a 1098-T tax form be still produced for me?

Per IRS regulations, educational institutions cannot produce a this form for students who are not eligible to receive one.